Access our on-demand webinar where industry experts unpack the hidden world…

Companies in the digital age have access to vast quantities of consumer data. Ask any CMO about their biggest issues when it comes to data, and chances are you’ll hear the problem isn’t that they have insufficient data; rather, the struggle most organizations face is turning all their data into useful insights.

According to a 2014 report by Dell Technologies, the amount of data created in 2013 measured 4.4 zettabytes (4.4 trillion gigabytes). The same report indicates that the annual volume of global digital data will reach 44 zettabytes by 2020.

This data explosion creates a dynamic landscape for organizations of all industries, but not everyone maximizes the opportunities this data can provide.

When it comes to optimally utilizing data, the corporate landscape is full of cautionary tales. Think about some of the higher-profile bankruptcies in recent years, such as Toys R Us or Sears, whose lack of a comprehensive and unified view of customer data doomed its attempt to apply data-driven plans to turn the company around. Going further, you can look at Blockbuster, at one time the most iconic brand within its industry. Blockbuster did not merely succumb to its industry’s disruption by Netflix — Blockbuster’s CEO rejected an offer to purchase Netflix in its infancy because he didn’t give credence to the direct-to-consumer, data-driven model of its fledgling competitor.

It wasn’t a lack of data that killed these companies. They had plenty of information on who their customers were and what they wanted, obtained through loyalty programs, corporate-branded credit cards, online tracking. Where they failed, according to the former CEO of Toys R Us, was in applying customer data to their business models.

It doesn’t matter if you’re running a startup or a Fortune 500 company; just having data gets you nothing. Too many organizations cut their focus short at storing and processing data, but they don’t stop and ask themselves, “What’s the impact this data can have on our business? What’s the next step for this data?”

There is a big difference between having data and using that data to inform business decisions. But there is an even larger impact when acting on those decisions can be automatic.

The Impact of Mature Analytics

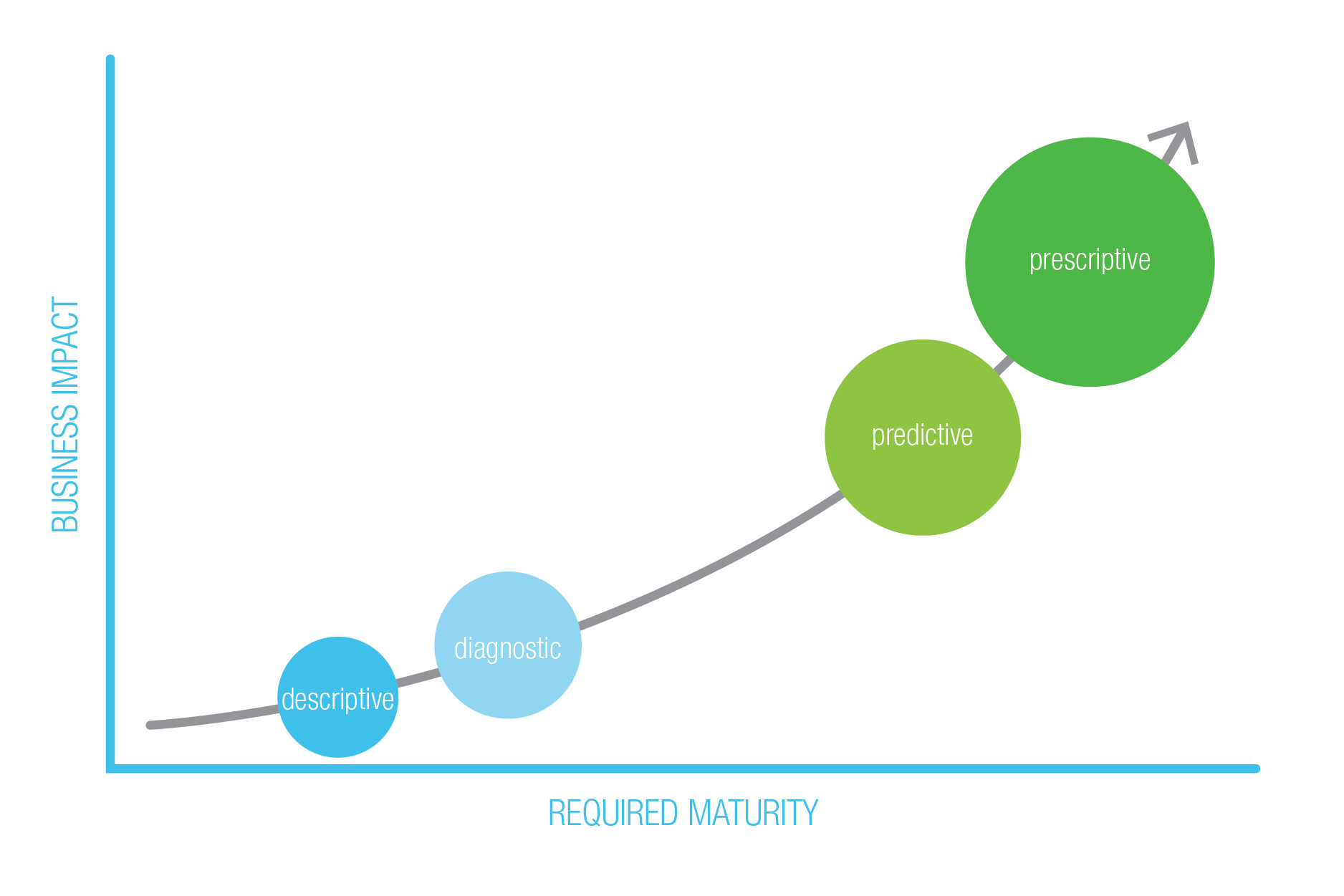

Most companies hang out in the descriptive and diagnostic areas of the graph above. However, companies that move up the analytics curve can future-proof their business and thrive across the next decade.

Most companies hang out in the descriptive and diagnostic areas of the graph above. However, companies that move up the analytics curve can future-proof their business and thrive across the next decade.

It’s not enough to know that something happened (descriptive analytics) or even why something happened (diagnostic analytics). Those are important baseline evaluations to gain from your data, to be sure; if you don’t understand your missteps (or even realize they happened), you’re likely to repeat them again and again. But if you stop with those levels of data analytics, you’re missing out on serious growth opportunities for your organization.

As you move up the chart to predictive analytics, you can begin to understand what is coming your way — a critically important ability in business but one that gets short shrift, nonetheless. Think about it: When you drive, do you spend more time looking in the rearview mirror, or do you usually focus your attention out the windshield? So why would you drive your company any differently than you drive your car?

Once you’re implementing predictive analytics, though, you can take it a step further and utilize prescriptive analytics. If your organization is swimming in data, why not use it to automatically prescribe what you should do? You can take your data and not only gain insights from it but rather put those insights to use in production. When you embed your discovered insights back into your transactional systems you can make timely actions at the point of the transaction — and that is where business transformation takes place.

Sounds good, right? But how can you get your organization to evolve from descriptive to prescriptive? How can you achieve data unification for your customers?

What Does Data Unification Mean?

First of all, let’s take a short step back. It doesn’t do any good to talk about unifying customer data if you don’t understand the meaning of data unification in the first place.

Data unification, at a high level, means combining all of the data your organization possesses, that spans multiple systems and formats and standardizing it so it can be treated as a single source. Why is this so important? When your data is siloed across different systems, the insights you can gain from that data are also siloed. Unifying your data unveils your customer’s journey across your entire brand instead of just within a particular department.

When your customer service team has insight into a customer’s online and offline touchpoints and purchases, marketing communications and the products he or she is most interested in, they are able to deliver a more personalized and rave-worthy experience. The ultimate goal is to defragment your customers’ stories.

But how can you possibly store so much data in so many forms? We’ll spare you from getting too technical right now, but a popular option you may be familiar with is a data lake — a vast repository of all different types of data, gathered together for storage. But like any data storage system, collecting it is only half the battle. The data is relatively useless to a business user in its raw, untamed state.

To keep the metaphor, think of all of the sources a lake may have. Underground springs, rivers and streams, rainfall, storm drains, even animals, dump sites and wastewater run-off. You need to drink water, but you’d be crazy (and likely get sick) if you simply dipped a cup in a lake like this and took a drink.

Similarly, a company can’t expect to just extract data straight from a repository like a data lake and gain actionable information. It has to be cleaned, processed and organized, taking it from multiple sources of input and transforming it into one structured and accessible resource able to be read and analyzed for insight.

A 360-Degree View

When you can unify your customer data, you gain a 360-degree view of your customer. Having connected data will lead to a more connected and personal customer experience. But how do you connect all of the siloed data you have on your customers?

Collect

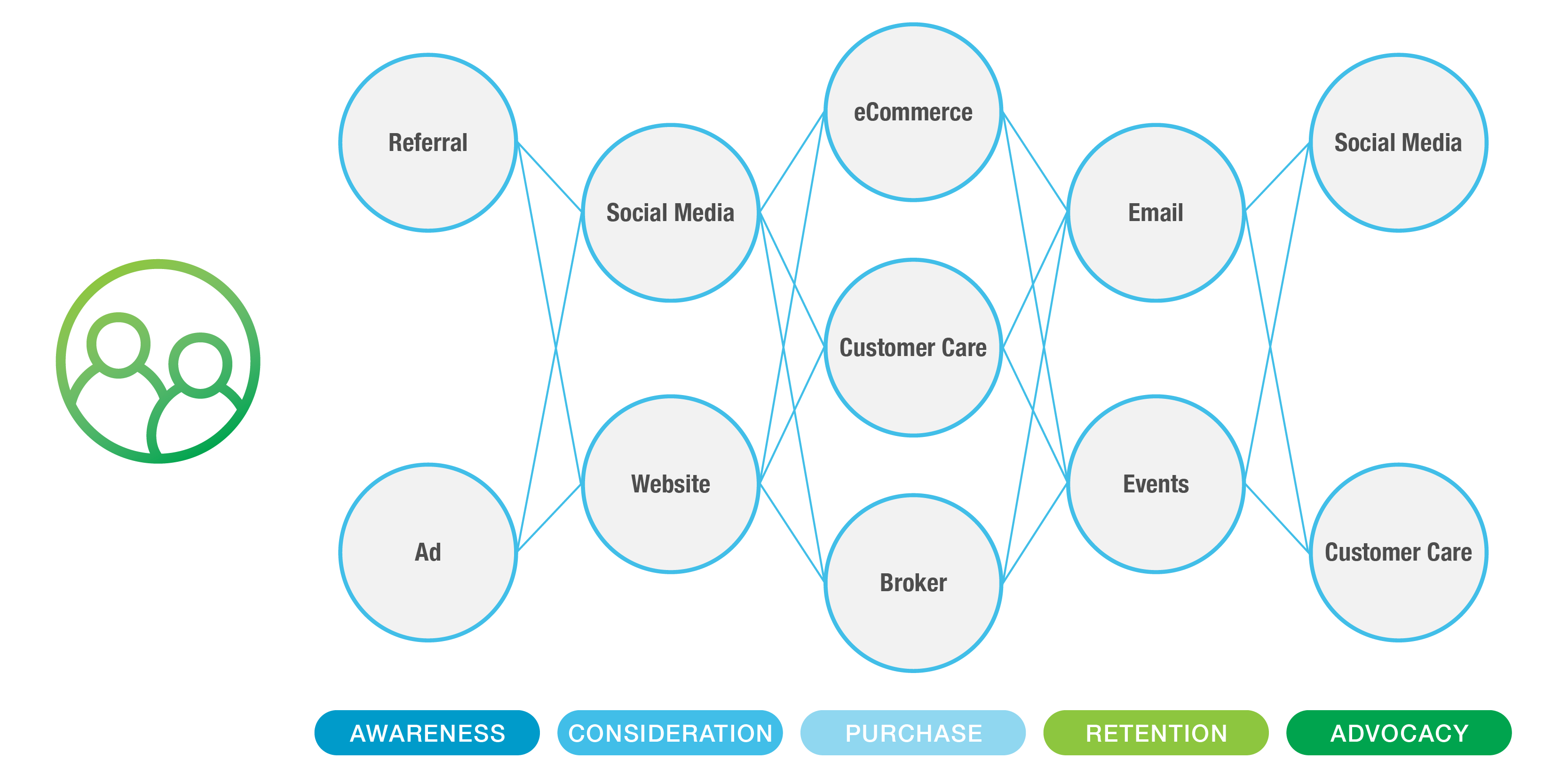

The first step in the customer data unification process is to identify all of the intersections your brand has with customers. Then you need to find a way to measure and collect data at each one of those specific intersections.

Each of these touchpoints yields different data points on your customers. You can also use an evaluation of your brand/customer intersections to conduct a gap analysis and identify what you know and what you don’t know, for current customers as well as for prospects.

Unify

Your next step is to unify the various data points you have and create a comprehensive view of your customers. Again, your end goal is to defragment customer stories and enable customer matching — not just aggregating customer data but building a profile that allows you to recognize each individual’s various data points as being the same customer.

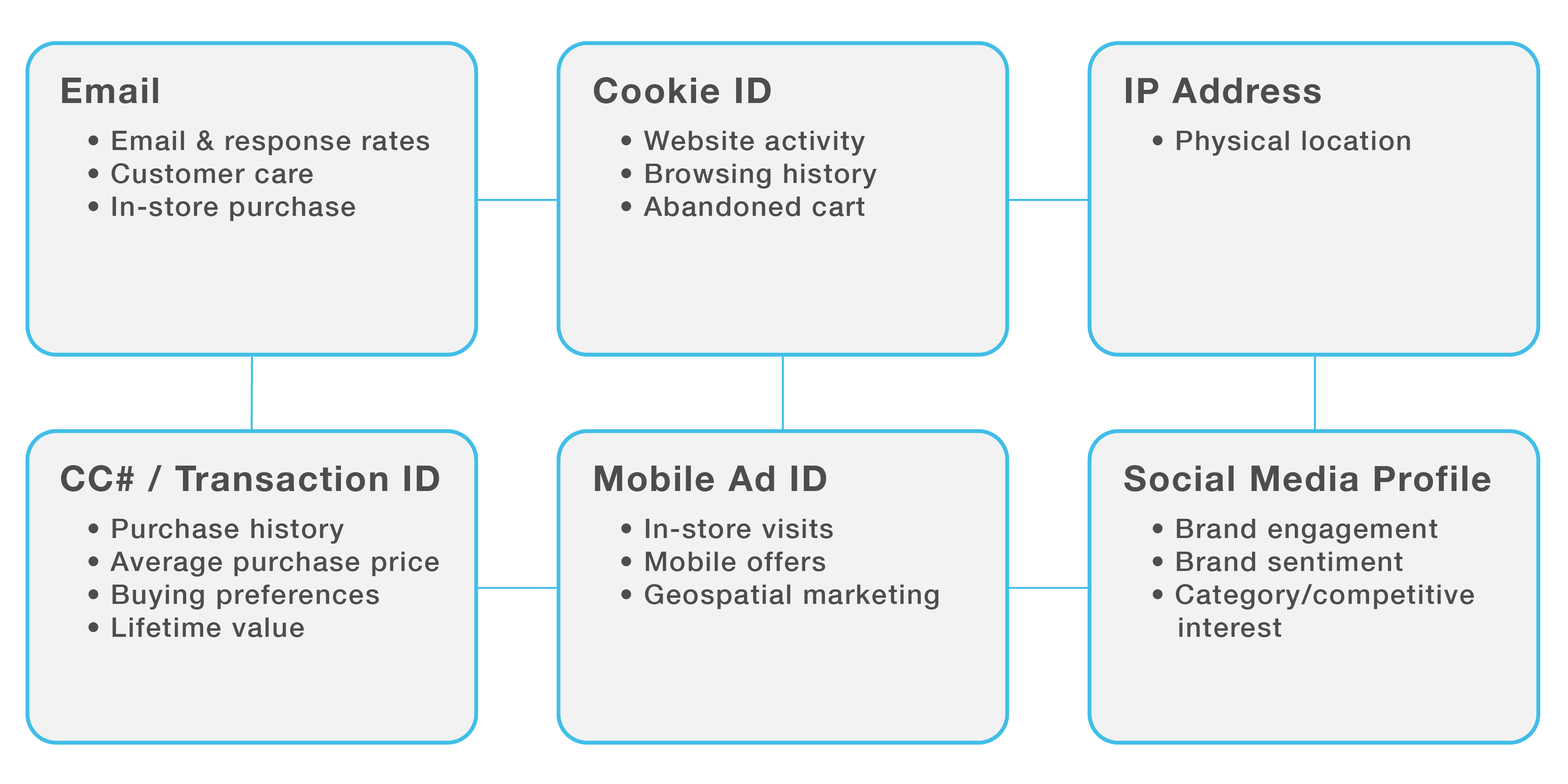

Six key identifiers are email address, cookie ID, IP address, credit card number or transaction ID, mobile ad ID and social media profiles. If you can layer all of that data into a single profile, you can achieve a unified view of your customers, their journey, where they are in their purchasing process and how they got there.

Once you can standardize and unify your data, giving you that complete picture of your customer, you can actually start to put it to use.

Analyze

The shift in today’s business landscape to big data allows for the storage of more data than ever before. But with so much data available, we come back around to the problem we established above: there’s not insufficient data, there are insufficient insights.

Without a definite strategy in data analysis, you’ll wind up sitting on an ever-growing collection of data that becomes more of a liability than an asset. But if you subject your collected and unified data to a thorough analytical process, you can uncover hidden nuggets that you can then operationalize and gain real value from.

Activate

The final step in the process is taking the data you have collected, unified and analyzed and activating it to gain quantifiable enterprise opportunities.

Having a unified customer view gives you greater marketing capability, benefit to your customer and benefit to your business. If you know who your customers are and can tailor their experience with your organization to match the profile you’ve established of them, you can use real-time insights to more effectively target communication, give customers a better overall experience, implement more targeted product development and see higher sales and increased loyalty.

For example, consider the above customer profile. We can get a dashboard of John’s interests and shopping habits, as well as recommended next steps to further engage him with our company and products. We know what communications have been effective in the past, and we have a view of his preferences from social media and his browsing history. In short, having a unified customer view for John leaves us much better positioned to convert.

Driving the Bottom Line

When you use data to move your company from a descriptive to a prescriptive model, you can react to changing conditions as they occur or even predict and stay ahead of them. Understanding trends as they occur, not days, weeks or months after the fact, will let your business operate as a category leader.

Organizations that better use data to gain business insights are expected to grow at an average of more than 30% each year. They are also predicted to take $1.8 trillion in annual business from competitors who don’t optimally use data.

Which category will your company fall in?

Don’t fall behind — talk with us at Zirous. Our data and marketing experts can help you navigate the potholes of big data and create a plan for the positives and the negatives that your unified data can predict.

This Post Has 0 Comments