How an Urban Hospital’s Emergency Department Used Newly Discovered Insights to Increase Their Bottom Line

Download the Case Study

Get Even More Insights with the Webinar

Overview

Changes to state Medicaid policy reduced the reimbursements hospitals are able to receive from insurance companies for the services they provide to Medicaid patients during a visit to the emergency department (ED), if the primary diagnosis for that visit is deemed non-emergent. One urban hospital with a substantial Medicaid population wanted to quantify the impact this policy change was having on their bottom line, and was looking for opportunities to recoup funds from visits that may deserve additional reimbursement. They chose Zirous to analyze their ED visit data and determine how they could best treat and serve their patients while ensuring accurate documentation and billing to maximize the insurance payments they deserve.

The Challenge

The biggest challenge facing this hospital when it came to uncovering these types of insights was lack of resource time. With their already limited billing and management staff strapped with reviewing clinical documentation, meeting submission deadlines, and reviewing denied claims, dedicating time to manually review their visit data was left to an as-needed, case-by-case basis. With more than 24,000 visits annually to this hospital’s emergency department, and with each visit resulting in almost 4 diagnosis codes, evaluating the visit data and quantifying the impact of their reduced Medicaid reimbursements would require more advanced analytics skills than they currently had.

But they knew this reduced reimbursement for non-emergent Medicaid ED visits was costing them; hospitals across the state had been appealing to legislators and governing bodies, claiming these changes would cost them millions. In fact, through our analysis, the amount this hospital was expected to absorb due to only receiving partial reimbursement came out to more than $2 million.

This hospital needed a way to identify if there were opportunities for some of that money to be recouped. Enter Zirous.

The Solution

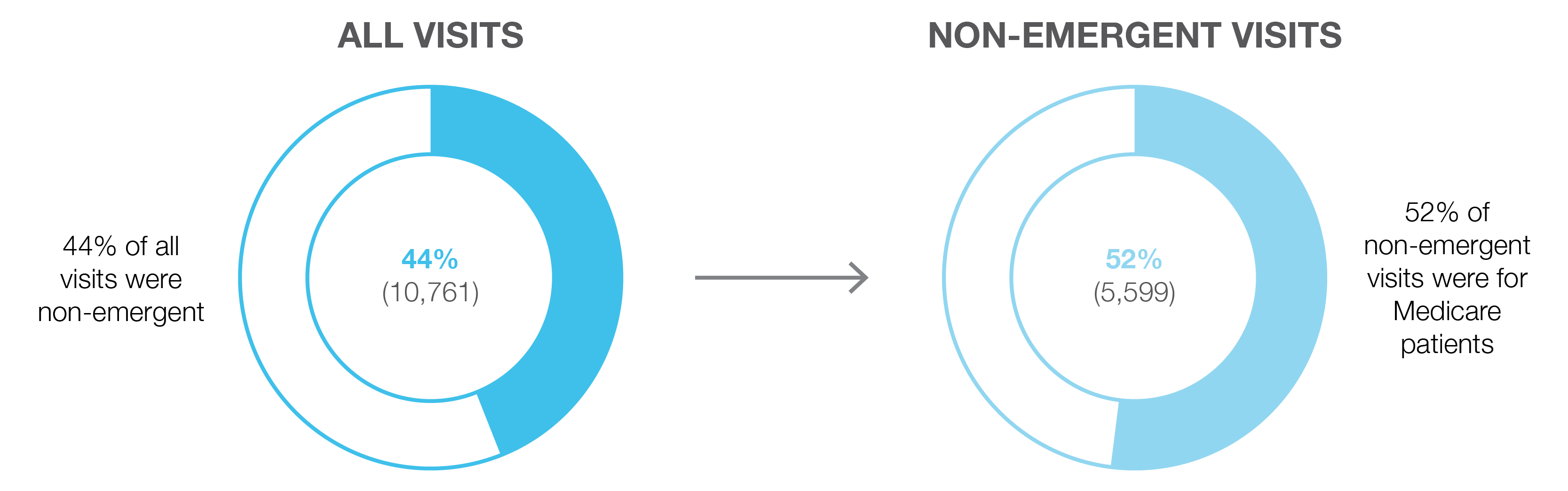

Zirous worked with hospital IT staff to obtain 12 months of de-identified data from emergency department visits. Through statistical analysis, we were able to join each diagnosis code to its respective visit ID to reveal that there were 24,711 visits to the ED in that calendar year. Of those, 44% were considered non-emergent based on the primary diagnosis of the visit.

Of those non-emergent visits, 52% of them were for patients who were on Medicaid. That meant that there were 5,599 visits to the ED that resulted in reduced insurance reimbursements, and that reduction in revenue was directly taken out of the hospital’s bottom line to the tune of more than $2 million.

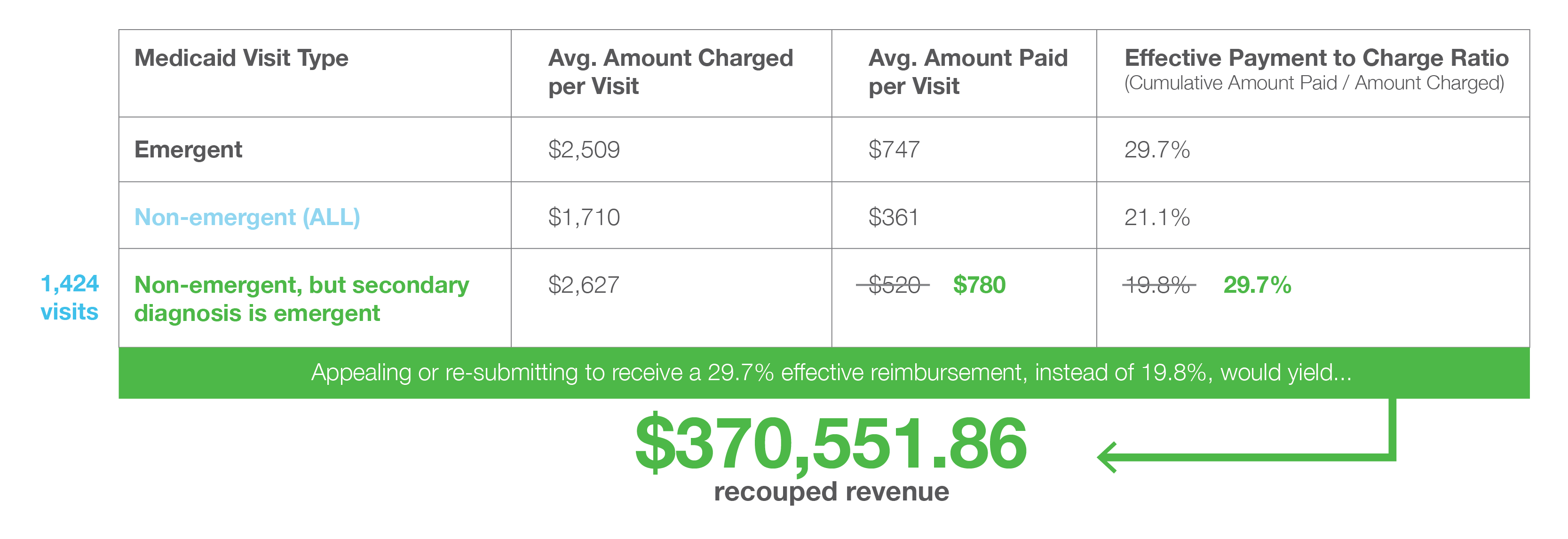

To find ways to recoup some of these lost dollars, Zirous explored characteristics of these 5,599 non-emergent Medicaid visits. Some of the most crucial insights uncovered were that 25% of these visits had an emergent diagnosis listed as the secondary diagnosis on the insurance claim. It was also quantified that the difference in the reimbursement rate for these visits with the secondary emergent diagnosis, compared to Medicaid visits with the emergent diagnosis listed as primary, was 9.9% lower.

The Impact

What if the billing representatives at this hospital could be made aware that they were submitting a non-emergent primary diagnosis, while the secondary diagnosis was actually emergent? We wanted to find out what that would mean from an additional revenue perspective.

If it was deemed appropriate for those 1,424 visits to have their secondary emergent diagnosis become the primary diagnosis, these visits would have been reimbursed at the emergent reimbursement rate, bringing an additional 9.9%, or $260, into the hospital for each corrected visit. This results in over $370,000 in recouped revenue.

By proactively monitoring a queue of claims that were submitted with a non-emergent primary diagnosis code but an emergent secondary diagnosis code, this hospital stands to add this $370k to their bottom line each year going forward. Additionally, by being able to monitor these claims at the time of submission, they save countless hours in not having to resort to a lengthy appeals process to be able to recoup these funds.

By proactively monitoring a queue of claims that were submitted with a non-emergent primary diagnosis code but an emergent secondary diagnosis code, this hospital stands to add this $370k to their bottom line each year going forward. Additionally, by being able to monitor these claims at the time of submission, they save countless hours in not having to resort to a lengthy appeals process to be able to recoup these funds.

Quick Facts

Company

- Urban hospital

- Serves a large population of Medicaid patients

- 24,000+ emergency room visits per year

Technologies Involved

- Python

- Jupyter

- Power BI

- Azure

Highlights

- An urban hospital faced high cost absorption due to Medicaid changes.

- With limited resources available to review cost-saving options, they brought in Zirous to perform advanced analytics.

- Real-time visibility into emergent vs. non-emergent claims could save the hospital nearly $400,000 annually in Medicaid costs.

You can do it, too.

This project, saving the hospital over $370,000 annually, was done in just three weeks. And your company can prove value and ROI in just a few weeks, too!